Despite the extension of the deadline by the Central Bank of Nigeria on Sunday, scarcity of the new naira notes worsened yesterday as Nigerians were…

Despite the extension of the deadline by the Central Bank of Nigeria on Sunday, scarcity of the new naira notes worsened yesterday as Nigerians were unable to get cash from counters in banks in many parts of the country.

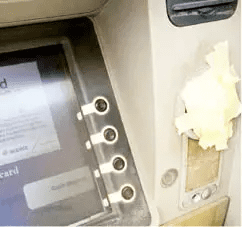

It was also tough getting money from Automated Teller Machines (ATMs) of the banks as well as Point of Sales (PoS).

Buyers and sellers, especially in informal markets were stranded as some of them were still finding it difficult to agree on cash transfers.

Even though it was Monday, many banks could not attend to desperate customers over the counter. On the other hand, PoS terminals that are a critical part of the payment system do not have the new naira notes to give customers.

Many of the operators said they had to use the “black market” to get both the old and new notes from “unexpected quarters”, hence their resolve to charge a lot of money from people who were willing to withdraw cash.

Some POS operators yesterday collected as much as N1,000 to release N10, 000. The total number of POS machines deployed by merchants and individuals across Nigeria hit 1.6 million in November 2022, according to the data released by the Nigeria Inter-Bank Settlement System (NIBSS).

There are approximately 17 automated teller machines, 147 point-of-sale devices and four bank branches for every 100,000 Nigerians, according to a new report by McKinsey.

However, most of these facilities, which were meant to facilitate a gradual transition to a cashless economy in Nigeria were somehow strangulated to the extent that they could not offer the needed services.

Some bankers told our reporters that they had been directed, and were being closely monitored, to ensure that no old naira note that got to the bank goes out again.

They also lamented that they were yet to get an adequate supply of the new naira notes to meet up with the increasing demands of their customers.

Efforts by this newspaper to get the actual amount of new notes printed by the CBN met a brick wall yesterday but some credible sources said it was not more than N200bn.

The CBN said over N3 trillion was in circulation but had mopped up over N1.9 trillion so far.

Daily Trust reports that the scarcity, which started at the weekend owing to the rush to beat the initial January 31 deadline for the return of old notes of N1, 000, N500 and N200 continued yesterday as most ATMs around Ikeja, Oshodi, Maryland and Lagos Island were out of cash.

Despite the extension of the deadline by 10 days, our correspondents observed that customers who visited banking halls for withdrawals were turned back as they were told that only deposits were accepted.

“The CBN must come out clean on this matter and the banks need to support the apex bank to make this policy work,” said Mrs Janet Obiora, who visited one of the banks in Ikeja.

“How can they claim they don’t have new notes despite claims by CBN that there are enough new notes in circulation? The two cannot be right, Nigerians require explanation,” she said.

However, a staff of one of the commercial banks in Ogba confided in Daily Trust that they were still awaiting new notes from the head office, promising that ATMs would be loaded as soon as the new notes were made available.

A journalist in Abuja, Abdullahi Yusuf, said he was at the UBA branch in Asokoro but could not withdraw at the counter.

“They told me to go to the ATM and when I got there, I could only withdraw N5, 000. It was the same at GTB around Jabi,” he said.

“This is really frustrating because Nigeria’s economy is driven by the informal sector; people need cash to do so many things. Sadly, the CBN had mopped up the bulk of the old naira notes and has refused to make the new notes available,” he said. Khadija Yusuf, a resident of Abuja said she visited at least five PoS operatives but could not get money because they also don’t have.

“The fifth PoS operator charged me N1, 000 instead of N200 before he gave me N10, 000. I had to pay the charges because I needed the money to buy fuel, which I ended up buying at N350 per litre at the black market,” she said.

Gunmen attack PoS operators, injures three in Bauchi

Hoodlums suspected to be armed robbers have shot and injured three people while trying to get new currencies from a PoS operator, carted away an unspecified amount of money in Zaki Local Government Area of the Bauchi State.

State Commissioner of Police, CP Aminu Alhassan, confirmed the incident yesterday at the Palace of Galadiman Katagum, Alhaji Usman Mahmood Abdullahi, when he accompanied Governor Bala Abdulkadir Mohammed to commiserate with the victims.

He said the victims came to get new currencies when the hoodlums trailed them and opened fire on them to scare people away.

He said that no life was lost but three people were injured.

It’s difficult getting money – Operators

Kehinde James, a PoS operator at Utako, Abuja, said they no longer get money from banks.

“The whole transition policy is not working because I was at three branches of First Bank and Access Bank where I maintain accounts but could not withdraw my money. I had to resort to what they called black market at Wuse market. I paid extra money to the trader and that is why I am also charging extra,” he said.

Hafsat Ismail, another operator along Adetokunbo Ademola Crescent, in Abuja, said she also got the new notes from “black market.”

“I paid N50 for every N1, 000 and that is why I am charging N100 for every N1000. If you want to withdraw N20, 000, you have to pay me N2, 000,” she said.

In Ado -Ekiti, POS agents charged N100 per N1, 000 new notes, resulting in N1, 000 per every N10, 000 transaction as against the previous N200 per N10, 000 before the introduction of the new notes.

In Kano, both the old and the new naira notes were scarce yesterday despite the extension.

Investigation revealed that the PoS operators now charge between N300 and N500 for N10, 000 withdrawals.

Malam Abdullahi Umar, a PoS operator along Zaria Road, said he closed shop since last Friday because he couldn’t get the new naira notes and also couldn’t get the old notes despite the fact that his customers were in need of cash.

Nasiru Ibrahim, who has a patient at Aminu Kano Teaching Hospital (AKTH), said he paid N500 to a POS operator to withdraw N10, 000.

“I wanted to buy food for my ailing father but had to walk for over two kilometres to get the POS operator who collected N500 from me. It is very sad,” he said.

Why e-payment may not address naira scarcity— Expert

The Fiscal Policy Partner and Africa Tax Lead at PwC, Mr Taiwo Oyedele, has said that encouraging Nigerians to use e-payment channels for transactions may not necessarily address the current scarcity of naira notes in circulation until the government makes e-payment easier and safer for the people.

According to him, many countries that have embraced electronic payments and minimal use of cash are doing so not because their currencies are scarce or to avoid penalties.

Instead, he said they do so because their economies run on credit even as e-payment is more convenient, safer, and incentivized than cash. Sharing his thoughts in a Twitter thread, Oyedele suggested that a more effective strategy by the CBN would be to make e-payments easy and attractive.

He said the apex bank would also need to supply as many naira notes as necessary and leverage intelligence to identify and punish criminals with illicit funds.

While noting that the amount of currency in circulation before the naira redesign was not the problem in Nigeria, Oyedele said: “As it turns out, Nigeria has one of the lowest amounts of currencies in circulation relative to GDP or per capita of N15, 200 (about $34) compared to the U.S. at $6,700 per capita, the UK at £1,200 per capita and the Eurozone at €3,600 per capita.

“Even if we consider the US dollar as a global currency, America has more dollars printed per person on earth ($280) than the amount of naira per Nigerian citizen ($34).

“Therefore, the real problem with naira in circulation is the illicit cash in the hands of corrupt persons and other criminals, which is best tracked and controlled through financial intelligence than currency restriction or scarcity,” he said.

DSS Intercepts syndicates

The Department of State Services (DSS), yesterday, said it had intercepted some members of organised syndicates involved in the sale of the new redesigned naira notes.

A release by the Public Relations Officer of the DSS, Peter Afunanya said that in the course of their operations in parts of the country, they also established that some commercial bank officials were aiding the economic malfeasance.

“Consequently, the Service warns the currency racketeers to desist from this ignoble act. Appropriate regulatory authorities are, in this same vein, urged to step up monitoring and supervisory activities to expeditiously address emerging trends.

“It should be noted that the Service has ordered its commands and formations to further ensure that all persons and groups engaged in the illegal sale of the notes are identified. Therefore, anyone with useful information relating to this is encouraged to pass the same to the relevant authorities.”

Source: https://dailytrust.com/pos-operators-hike-charges-amid-naira-notes-scarcity/