The Nigerian Exchange Limited has announced that the value of its securities lending market rose to N513m as of August 20, 2021.

Securities lending is the market practice of transferring shares for a fee from a holder who is the lender to another party representing the borrower, with the borrower agreeing to return the securities to the lender either on demand or at the end of the agreed loan term.

NGX said in a new report that there was an uptick in stakeholders’ participation as 2.3 million units of MTN Nigeria Limited valued at N395.6 million was borrowed.

Data obtained from the report showed that the volume of units as of 2019 stood at 61,435 valued at N344,555. In 2020, it grew to 7.38 million valued at N95.2m; and as of August 20, 2021, it stood at 6.8 million units valued at N513.1m.

The report also gave the breakdown of the companies that pledged the shares, with Zenith Bank Plc pledging 77.33 million shares; MTNN, 8.89 million shares; Dangote Sugar, 43 million shares; GTCO, 31.09 million shares; and UBA, 45 million shares.

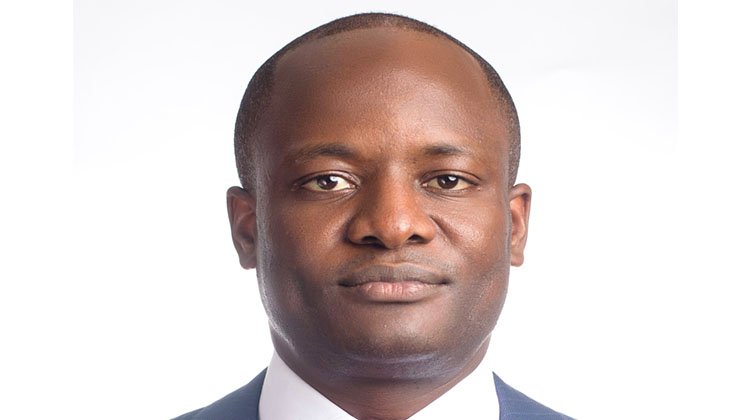

During an interactive session with investors held by the NGX recently, the Head, Trading Business Division at the NGX, Jude Chiemeka, said that securities lending presented significant benefits to investors in a bull or bear market.

He said, “Whether you are a speculative investor looking to make quick gains, or a long-term investor holding stocks, securities lending provides strong potential to deliver benefits to all market players through capital gains and low-risk incremental income.

“It also plays an important role in the capital market by providing liquidity, which in turn reduces the cost of trading and promotes price discovery.”