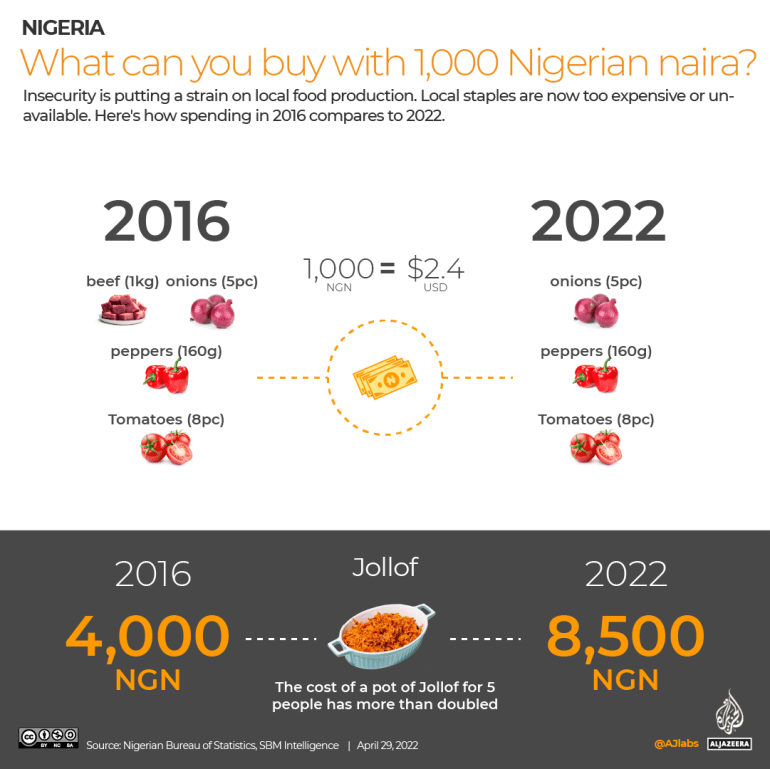

The hike in inflation means the purchasing power of Nigerians, some of whom live on a monthly minimum wage of less than $50, is declining.

Inflation in Africa’s most populous country soared to 16.8 percent in April, driven by fuel price increases and accelerating costs for food, including bread and cereals, newly released data from Nigeria’s National Bureau of Statistics (NBS) has shown.

Annual food inflation rose to 18.4 percent from 17.2 percent in March, sending the headline rate to 16.8 percent, the highest in eight months, according to the data released on Monday.

The jump in fuel and food items costs is driven by global supply disruptions following Russia’s invasion of Ukraine, analysts say.

Prices for wheat, a key ingredient in cereals and flour for pasta and bread, have jumped more than 5 percent over the weekend, and over 68 percent year-on-year, according to commodities data compiled by the Financial Times.

Shortages of jet fuel have led to airline operators increasing fare prices by nearly 100 percent or in some cases suspending operations as the price of the commodity rose from 190 to 700 naira ($0.46 to $1.69) per litre in the wake of Russia’s invasion of Ukraine.

The hike in inflation means the purchasing power of Nigerian consumers, some of whom live on a minimum wage of 18,000 naira ($43.35) per month, is being eroded, Ikemesit Effiong, analyst and head of research at Lagos-based sociopolitical risk advisory firm SBM Intelligence, told Al Jazeera.

“Nigeria is not just dealing with rising inflation,” Effiong said. “When combined with high levels of unemployment and low growth – public and private – Africa’s largest economy is in the throes of an extended bout of stagflation.”

Increased insecurity across parts of Nigeria and the slow ramp-up of election spending could also combine to ensure that prices will remain high for much of the rest of the year, he added.

While pressure mounts on Nigeria’s policymakers to tighten benchmark interest rates, monetary policy committee members “will stick to their guns and keep interest rates on hold over the coming months”, Virag Forizs, who focuses on the Middle East and Africa at London-based Capital Economics, wrote in an emailed note to investors.

According to Effiong, rising inflation “will continue to reinforce the pressures buffeting the Nigerian consumer as well as the relative undesirability of Nigeria as an investment destination. Both constituents will continue to price this continued economic uncertainty into their near and long term decision-making.”

Persistent double-digit inflation could hamper the growth of the Nigerian economy that “experienced its deepest recession in four decades” in 2020, the World Bank had said in a “Time for Business Unusual” report released in November 2021.

“Even though Nigeria’s economy exited a pandemic-induced recession, several challenges persist including double-digit inflation, declining incomes, and rising insecurity,” Shubham Chaudhuri, the World Bank’s country director for Nigeria, said in the report. “While the government took bold policy measures to mitigate the impacts of the COVID-19 crisis, the reform momentum has slowed which hinders Nigeria’s ability to reach its growth potential.”

The headline index rose by 1.76 percent in April 2022, compared to 1.74 percent last month, and the urban inflation rate increased to 17.35 percent in April 2022 from 18.68 percent recorded in April 2021. The rural inflation rate rose to 16.32 percent in April 2022 from 17.57 percent in April 2021, according to the NBS data.